Wealth

Maximising returns from your investment

Everybody knows the significance of ‘return on investment’ (ROI). If you have a Buy-to-Let investment portfolio, it’s important to know how to measure the performance of your investment and the key areas to focus on to maximise returns and to create wealth from your investment.

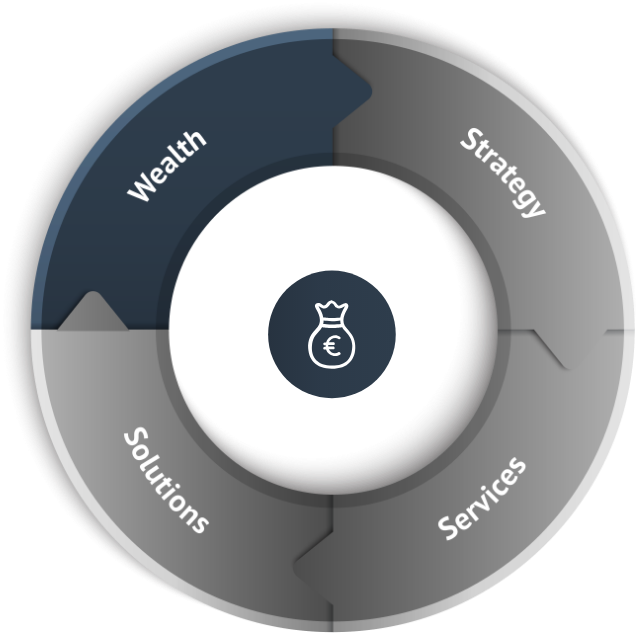

OUR WEALTH MANAGERS FOCUS ON:

- Capital Preservation: We help to protect your hard earned funds

- Income & Cashflow: Properties bought to earn income through renting

- Capital Appreciation: Increasing the value of your property portfolio

- Mortgage Repayments: Tenants repay and reduce your Mortgage Debt

Wealth

Capital Preservation

We help to protect your hard earned funds

While every investor has their own set of investment objectives and risk profile, this strategy often becomes an important part of portfolio management to ensure that your investment value doesn’t decrease and your capital remains safe. Mainly it is used as an important part when planning for retirement when making money becomes less important than keeping what you already have. Inflation is the main enemy of wealth preservation but a residential property investment with capital preservation in mind is a great store for wealth – it endures ups and downs, but has a long term upward value trend. A Capital preservation strategy doesn’t guarantee that house prices will rise in a straight line, or that they won’t reduce occasionally, but historically it shows that over the longer term inflation will also drive up house price values which protects the value you have invested in the property. It may offer a safe haven from market volatility, protect against weak economies or any other uncertainties.

Wealth

Income & Cashflow

Properties bought to earn income through renting

A common practice for investors is to purchase residential income properties with the intent that rents will cover at least their monthly expenses, they can be increased over the time and property can be sold for a larger capital gain or kept as a passive income generator. By choosing an income generating strategy, typically investors would invest in a property occupied with tenants, preferably fully rented at all times, generating a stable rental income. The target would be to rent the property for the highest possible rental rates where after covering all the costs the investors would still have income left over which could be re-invested to increase the property value or taken out as income for the investor. The level of gearing is also important for this type of strategy to succeed. The higher the mortgage loan to value, the higher monthly repayment and less available cash leftover. Therefore, investors who are choosing immediate income as their main strategy need to invest significantly higher equity amounts than those, who are planning for a future income from their investment.

Wealth

Capital Appreciation

Increasing the value of your property portfolio

Capital appreciation often refers to a rise in the value of your asset, mainly the difference between the purchase and sales price. If your investment strategy is aimed at capital appreciation your goal should be to receive a higher price for your investment than you originally paid for. The value of your investment can increase for several reasons eg: demand from population growth or lack of supply. However, for new investors unfamiliar with the German market it might be a difficult strategy to predict long term. Investix helps investors to analyse the overall macro trends, such as GDP growth or bank policies of lowering interest rates. Investments targeted for capital appreciation tend to have more risk than assets chosen for capital preservation or income generation, but they also might generate more wealth in a long term. Typically, these investors are looking for properties in up and coming areas, in a central location and in a good condition. This strategy normally is part of a long term investment plan.

Wealth

Tenant pays your mortgage

The invisible savings account

Most investors regard paying down the mortgage debt as the least exciting but as most successful investors will tell you, it is one of the most effective ways to generate wealth. Holding a Buy-to-Let property for an extended period means that every year you are using the tenant’s money to pay off your debt. As the debt lowers, your invested equity grows creating new wealth for the investor. The higher your initial property leverage amount, the less opportunity the property will have to work as an immediate income investment. Usually investors, focused on this strategy, will try to secure low interest rate mortgages so most of the rental income can be used to repay the principle of the mortgage. With interest rates so low in Germany, investors will go a step further and fix the rate of interest for periods of up to 10 years. Many investors regard the monthly repayment of mortgages as their invisible savings account which can be accessed at some stage either by refinancing or selling the property.