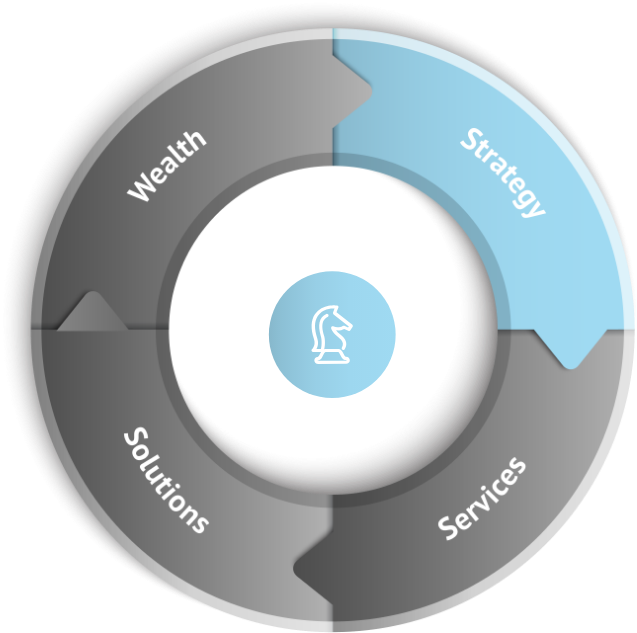

Strategy

An investment in knowledge pays the best interest

Real estate can provide much better yields compared to other investments but it is important to have the right strategy from the start. If you haven’t started your property investment journey yet, but have some money to invest and want to make a solid return, its not simply a matter of making sure you have the right strategy, but more importantly, the right support from a company that has the knowledge of the local market.

OUR KEY INVESTMENT STRATEGIES INCLUDE:

- Buy-to-Let: For Positive Cash Flow and potential Long term gain

- Buy-Renovate-Sell: For a good springboard into Property Development

- Property Development: For Large Scale Property Development projects

- Passive Investments: For Returns without any substantial involvement

Strategy

Buy-to-Let

Positive cash flow and potential long-term gain

This is perhaps the most popular form of residential property investing in Germany and is typically the first, and sometimes only, strategy many real estate investors employ. The Buy-to-Let real estate strategy is exactly what its name implies, it is the process of acquiring real estate (the ‘Buy), particularly rental property, to own and profit from it over a long period of time by renting it out (the Teti). It involves careful selection of investment properties, financed well, and managed well, with an eye towards positive cash flow and potential long-term gain. Most investors will use a mortgage in Germany when purchasing a Buy-to-Let property as leveraged investments in Germany generally generate higher returns.

Investix Buy-to-Let strategies include:

- Cash vs Leveraged ‘Buy-to-Let’ strategies

- Financing options

- Advice on the best ‘Buy-to-Let’ locations in Germany

- Step by step guide to investing in Buy-to-Let properties

- Potential return on investment forecasts

Strategy

Buy - Renovate - Sell

A good springboard into property development

Renovating houses for a profit should be easy. You buy low in the market, apply some refurbishments and renovations to the property, and sell or rent out the property for a very nice profit. Investix has an eye for what a renovated property will sell for in its local market. When we assess a property renovation project we start with the end in mind. An awareness of all the figures required for purchase, renovation and resale will help to guide all the renovation decisions and, ultimately, which property you invest in. For any property you’re thinking about renovating, you need to be fully aware of how much work is needed, how much that work might cost and how much the renovated property will be worth on completion.

Investix Buy-Renovate-Sell strategies include:

- Advising on the best Locations for renovation in Germany

- Costing plans for renovations

- Legal obligations for a renovation

- Key checklist for a successful renovation

- Design and planning

Strategy

Property Development

End-to-end property development service

Investix clients don’t need to educate themselves on property development, the markets, economics, finance, town planning, the construction processes and the marketing of real estate projects. Our Property Development Consultancy division delivers high quality consultancy, sales and marketing advice to developers, landowners, banks and investors. Understanding the requirements of institutional and high-net-worth property investors, a key expertise built up by Investix having worked successfully with equity partners in the residential property development market in Germany for over 20 years. We invest in both small and large scale property development projects and we always strives to deliver the complete property development solution to our clients.

Investix Property Development strategies include:

- Best Locations to source Land for development in Germany

- Co-Development & Project Management services

- Cost of development and key checklist

- Planning applications and legal considerations

- Investment planning & forecasts

Strategy

Passive Investments

Returns without any substantial involvement or effort

Passive income investments can make an investor’s life easier in many ways, particularly when a hands-off approach is preferred, but it means giving your money to someone else to make the investment happen. Popular passive investment products include property funds, reits property bonds, and crowdfunding. Passive property investments are typically suited to investors with a lower amount of equity looking for very little involvement and to benefit from economies of scale. Usually investors will receive more regular payouts from their passive investment compared to traditional buy-to-let investments and will normally commit their investment funds for a short period than traditional property investing.

Investix Passive Investment strategies include:

- Advising how Passive investments compare to Buy-to-let investments

- Advantages and Disadvantages of Passive investments

- How are the investment funds commonly secured

- Where are the funds typically invested

- Typical investment time schedules and returns