Leverage, or debt financing, is an important and even necessary part of most real estate deals. However, as the 2008 – 2009 global real estate downturn highlighted, there are times when too much leverage on an asset can be a recipe for heavy losses. So, it is important for investors to understand leverage, the pros and cons of using it, what amount of leverage is prudent in a given situation and how it can influence the risk and reward of real estate investments. Most investors in Germany take advantage of debt financing especially considering that interest rates are currently very low. What makes German mortgages very attractive is when investors can “Fix” these low interest rates for the next 10 years or longer in some cases. A fixed-rate mortgage loan lets you accurately predict the amount you will have to pay each month for your investment – enabling you to determine your budget with accuracy. As a fixed monthly payment, it also protects you against rate rises as opposed to variable rate mortgages that rise and fall with interest rates.

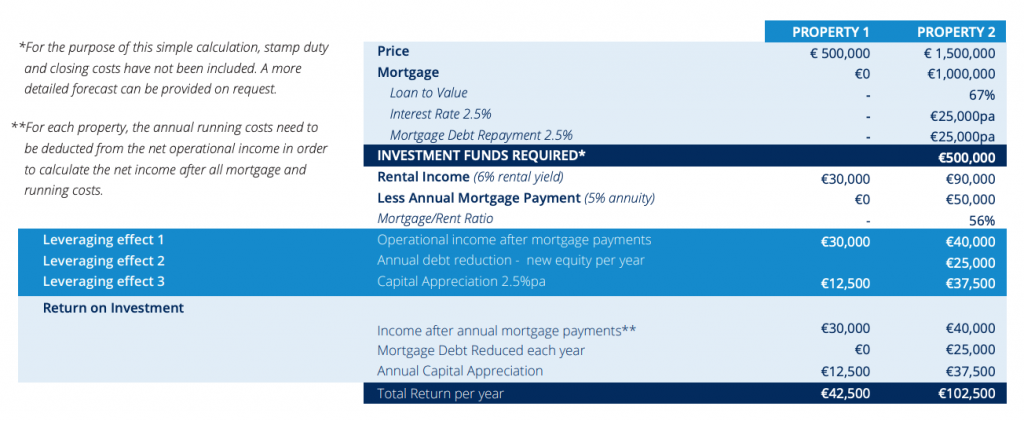

Below you can see a table comparing two investments based on the same investment amount of €500,000, with one paying cash for their property and the other using a fixed interest rate mortgage. Outlined in the chart are the three main benefits of using leverage.

Leveraging effect 1: More operational income – Using a mortgage allows you to purchase higher value property generating more rental income for the same investment amount. A prudent lender will not focus on LTV (Loan to Value) but will focus on MRR (Mortgage to Rent Ratio). In this case with a mortgage to rent ratio 56% it still leaves you with a higher net rental income on the yearly basis than if you would have purchased the property with cash.

Leveraging effect 2: Increasing initial investment capital – By paying down the mortgage you accumulate new equity which helps to grow your initial investment capital. This profit can be realized when selling or re-financing the property at a later date.

Leveraging effect 3: Higher returns from Capital Appreciation – Assuming both properties appreciate by 2.5% in the first year even though the two properties had the same amount of equity to start and both experienced the same percentage of property appreciation, Property 2 generates a higher gross profit when selling. This discrepancy in profits highlights

the power of leverage in generating returns, assuming that things go well.

It’s easy to see why the majority of investors choose to use a mortgage to leverage their property investment. With the same investment amount, you can more than double your yearly returns.